2025 FINDIT Taiwan Early-Stage Investor Confidence Survey: AI Dominates, Investor Confidence Holds Firm

As the global AI boom gains momentum, the venture capital market is once again heating up. Among the many deals competing for attention, only those linked to “AI” appear capable of capturing investor interest. At the same time, we are witnessing two parallel developments: the industrialization of AI and the AI-driven transformation of various industries. While AI remains dominant, rapidly shifting global political and economic conditions are also having a significant impact on the investment landscape. Compared with the capital downturn following the COVID-19 pandemic, today’s uncertainty-driven volatility is making investment decisions more difficult and the overall outlook increasingly unpredictable. In response to these dynamics, we conducted a survey targeting early-stage investment institutions in Taiwan. The goal was to assess local investors’ perspectives on market outlook and key investment drivers. The findings provide a clear reflection of the major shifts shaping the investment landscape.

1. Broadening Investment Scope with Optimism Toward Market Shifts

Between April 17 and June 12, 2025, FINDIT team conducted a survey of 53 early-stage investment institutions across Taiwan. Respondents included venture capital firms, corporate investors, and angel investors. The survey covered a range of topics, including investment intention, investable capital, exit activity, industry outlooks, key investment drivers, and focus areas.

1.1 Optimistic Investment Outlook: Investment Intention Continues to Grow in 2025

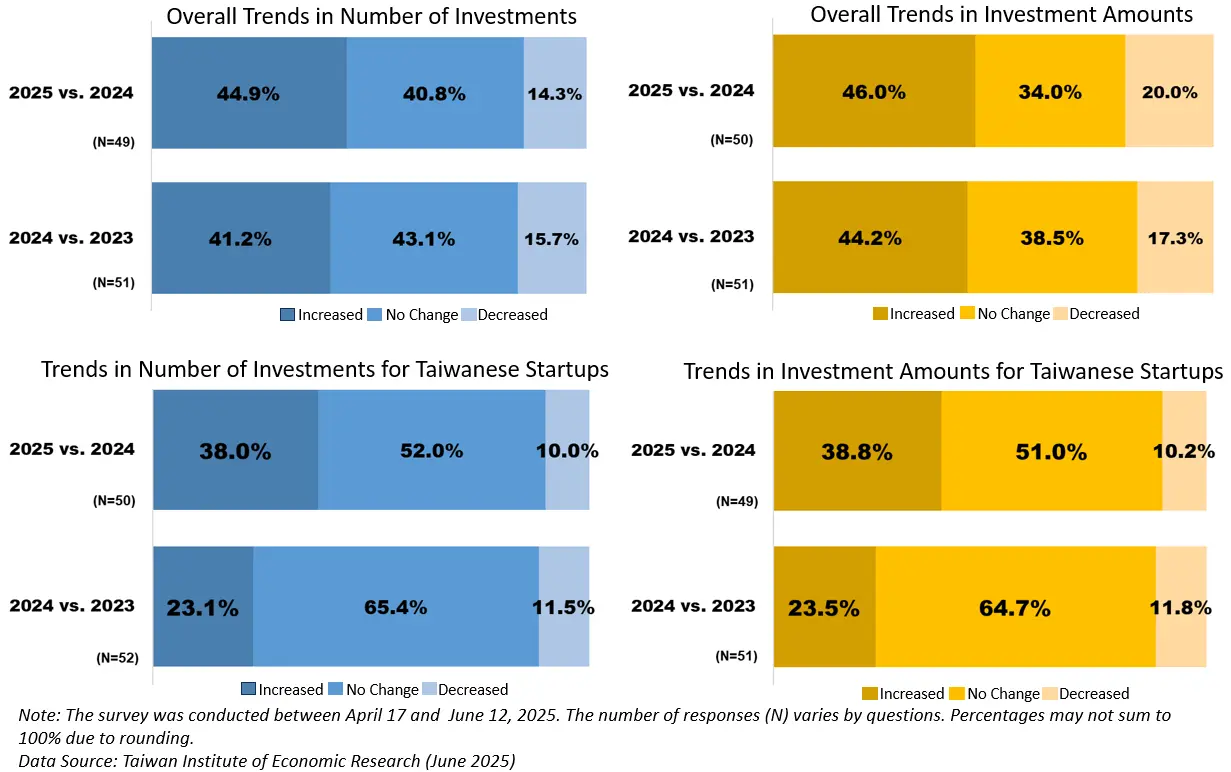

To begin with the overall investment intention, compared with 2023, 41.2% of domestic respondents reported an increase in total investment deals in 2024, significantly higher than the 15.7% who reduced their investments. Likewise, 44.2% of respondents increased their investment amounts, far exceeding the 17.3% who scaled back.

Looking ahead to the full year of 2025, the optimistic sentiment seen in 2024 persists. More than 40% of respondents expect to further increase their investments, with 44.9% anticipating a rise in deal cases and 46.0% projecting larger investment amounts. These figures even surpass those expecting to remain unchanged, suggesting that domestic investors are ready to take a more proactive approach and expand their investment scale.

1.2 Cautious yet Optimistic Toward Investing in Taiwanese Startups: Investment Remains Conservative but Shows Steady Recovery in 2025

A closer look at the investment intent toward Taiwanese startups shows that, although generally more conservative compared with overall investment trends, only about 10% of respondents indicated they would reduce their investments. Compared with 2023, over 60% of respondents indicated that their number and amount of investments in Taiwanese startups remained unchanged in 2024, accounting 65.4% and 64.7% respectively.

However, the proportion of respondents increasing their investments (23.1% in number of deals and 23.5% in investment amount) was still higher than those reducing investments (11.5% and 11.8%, respectively). Moreover, domestic investors appear more optimistic about investing in Taiwanese startups in 2025, with 38% expecting to increase the number of deals and 38.8% anticipating higher investment amounts compared with 2024.

1.3 Enhanced Capital Flexibility: Investable Capital on the Rise

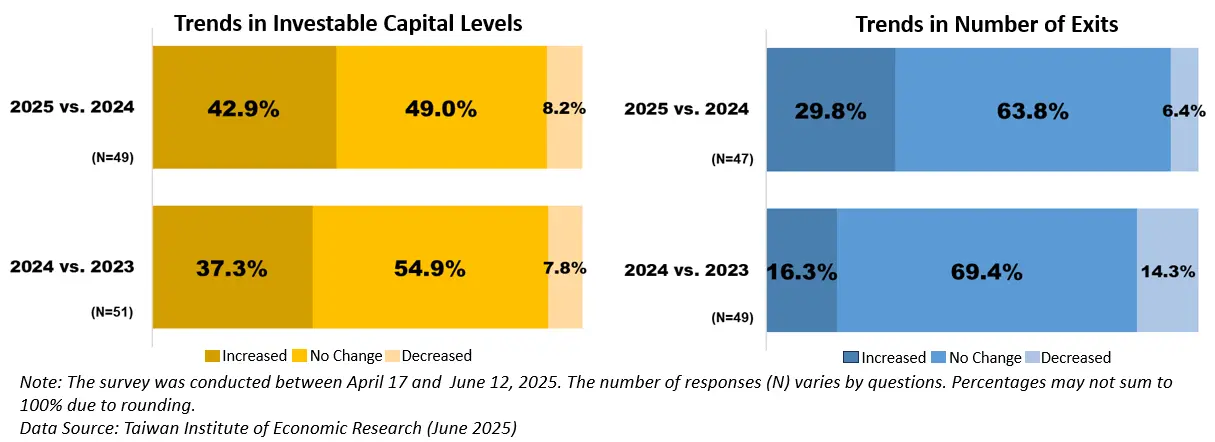

Regarding changes in investment capacity, 54.9% of respondents reported unchanged in 2024 compared with 2023, while 37.3% saw an increase, significantly higher than the 7.8% who reported a decrease. Moreover, amid ongoing market uncertainty, investors appear more willing to expand their investments, with 42.9% expecting investable capital to grow in 2025.

This trend may be partly driven by optimistic expectations for exit opportunities. In 2024, exit activity remained stable compared with the previous year, with 69.4% reporting unchanged, 16.3% an increase, and 14.3% a decrease. For 2025, although 63.8% of investors still expect steady exit activity, the proportion anticipating an increase has risen to 29.8%, while those expecting a decrease have dropped to 6.4%. This shift suggests a more positive outlook on exit opportunities.

These survey results show early-stage investors’ positive outlook toward Taiwan’s capital market policies. In January 2025, the Taiwan Innovation Board 2.0 officially launched, removing restrictions on qualified investors and significantly boosting investor participation and market liquidity. In February, the Taipei Exchange (TPEx) announced the opening of the “Listed to OTC” mechanism, creating opportunities for companies to transition between different market boards. Supported by strong policy incentives and proactive regulatory efforts, these initiatives not only foster startup growth but also strengthen investment momentum in Taiwan’s capital market, ultimately creating more favorable conditions for startup investment.

2. Investors Expect Market Downturn, Is Confidence Holding Steady?

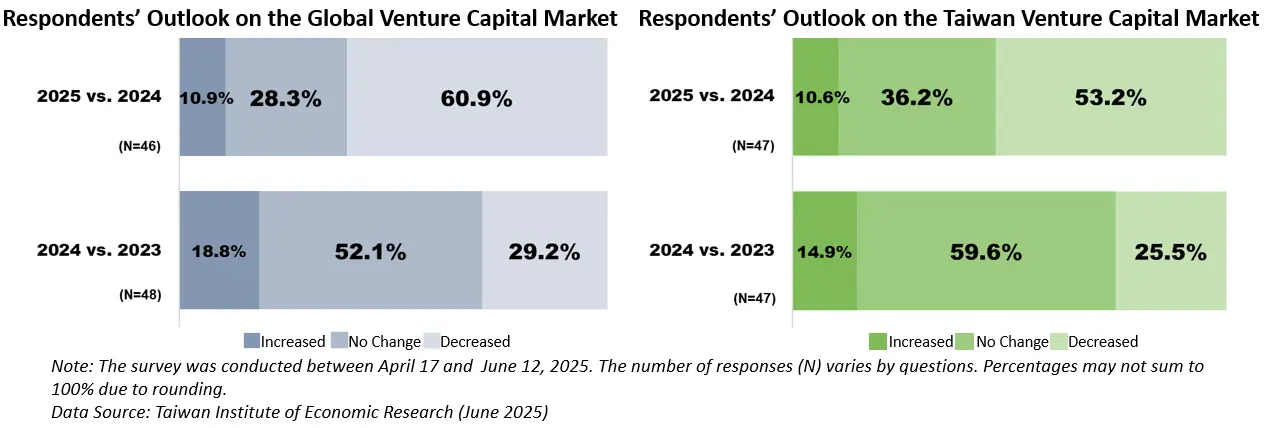

Regarding perceptions of the global venture capital market, 60.9% of respondents expect a downturn in 2025, a significant increase from the 29.2% in 2024. Only 10.9% anticipate market improvement, while 28.3% expect conditions to remain stable. Additionally, international market sentiment has influenced respondents’ views on Taiwan’s venture capital market. Compared with the previous year, a higher proportion of respondents (approximately 59.6%) believed the market remained steady in 2024, while 25.5% expected a decline and 14.9% anticipated growth. In 2025, the proportion expecting a downturn rose to 53.2%, with 36.2% expecting stability and 10.6% predicting improvement.

Interestingly, despite more than half of respondents perceiving a pessimistic outlook for both domestic and global venture capital markets in 2025, their institutions’ investment confidence has not diminished. Many anticipate increasing their investment scale and investable capital in 2025. This suggests that, despite a highly uncertain environment, domestic investors continue to seek breakthrough, innovative, and promising opportunities, expanding their portfolios and seizing every potential.

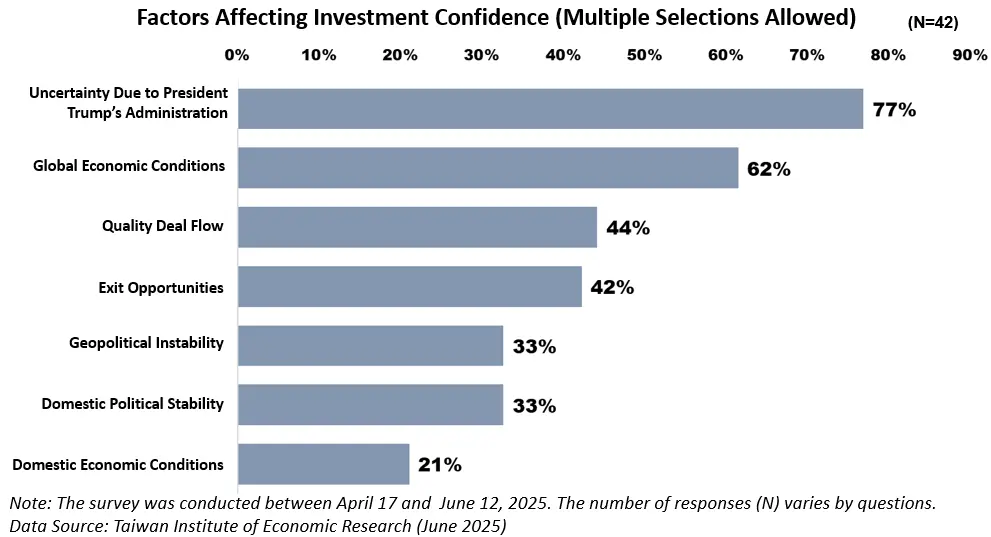

To better understand what shapes respondents’ outlook, we further surveyed the factors influencing their confidence. Unsurprisingly, 77% cited the uncertainty due to President Trump’s administration as a major concern. Closely following, 62% pointed to rapid changes in the global economic climate. In contrast, only 21% indicated Taiwan’s domestic economic conditions affected their confidence. Regarding investment deals, “quality deal flow” (44%) and “exit opportunities” (42%) remain key concerns. “Geopolitical instability” (33%) and “domestic political stability” (33%) also significantly influence confidence levels.

Overall, a stable external investment environment serves as a key driver of investor confidence. From a policy perspective, strengthening the nurturing of promising startups, improving visibility of quality deal flow, and expanding exit opportunities could further strengthen investment sentiment.

3. AI Is Everywhere: A Mandatory Subject for Investors

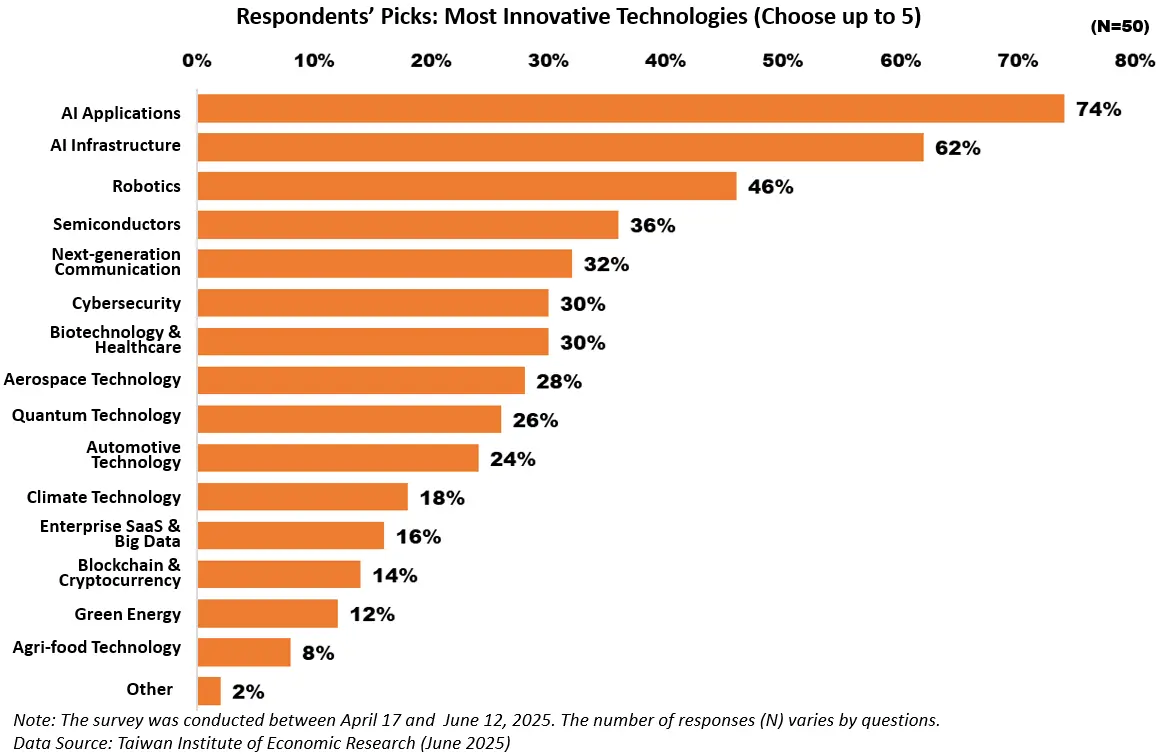

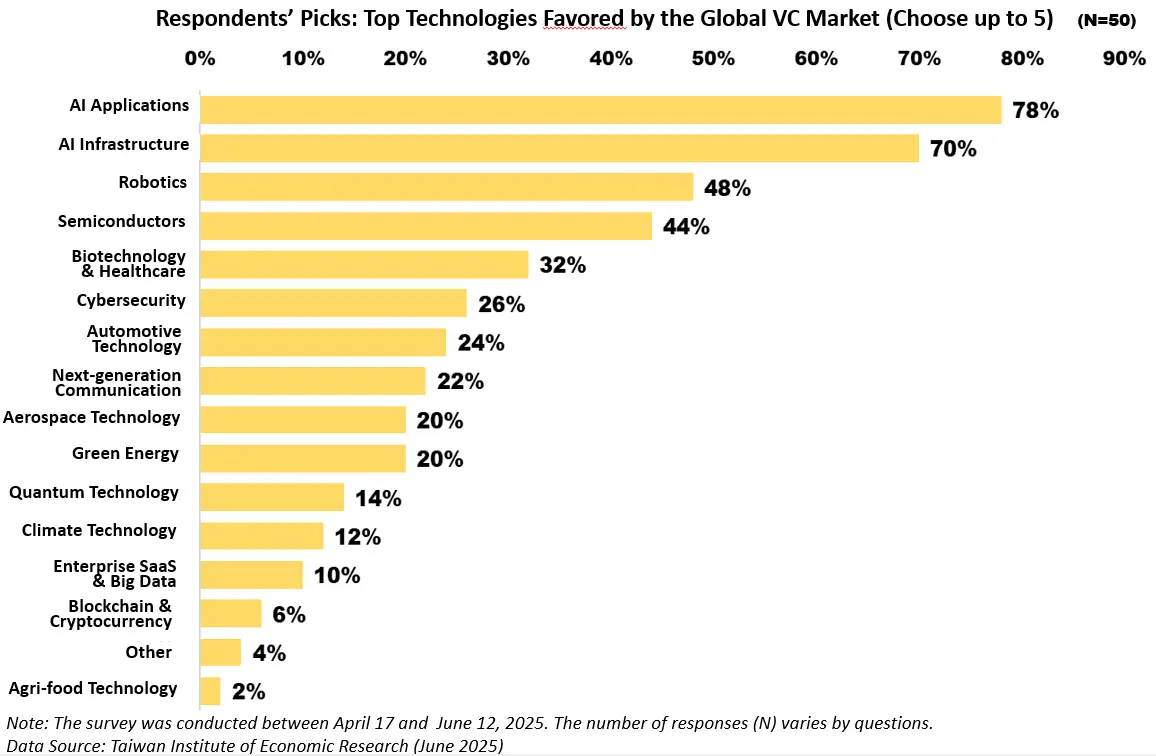

AI has become the most prominent focus for investors in recent years. Deals currently seeking funding increasingly find it difficult to attract investors unless their offerings incorporate some level of AI capability.. In this survey, AI again stood out: 74% of respondents identified “AI Applications” and 62% cited “AI Infrastructure” as the most innovative technologies, followed by “Robotics” (46%) and “Semiconductors” (36%). These results inevitably recall the AI roadmap outlined by NVIDIA CEO Jensen Huang, from traditional data centers to massive AI data centers powered by thousands of GPUs, and from Agentic AI to Physical AI that interacts with the real world. Respondents also highlighted these four sectors as the most promising technology areas in the global venture capital market. Compared with earlier focuses such as biotechnology and healthcare, the rise of AI made a significant impression on investors.

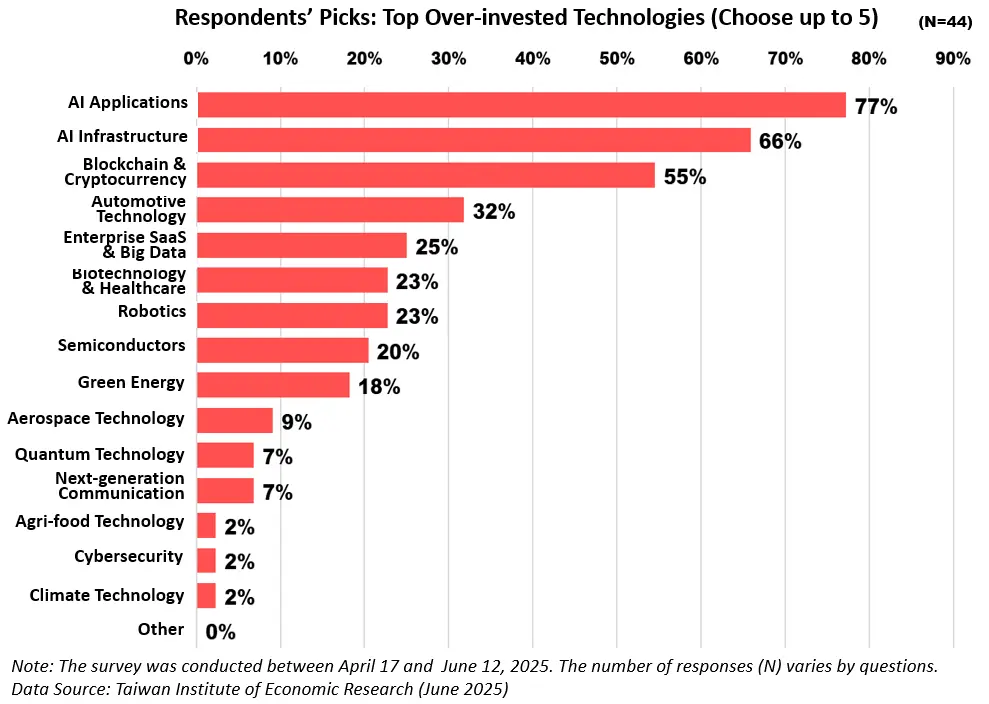

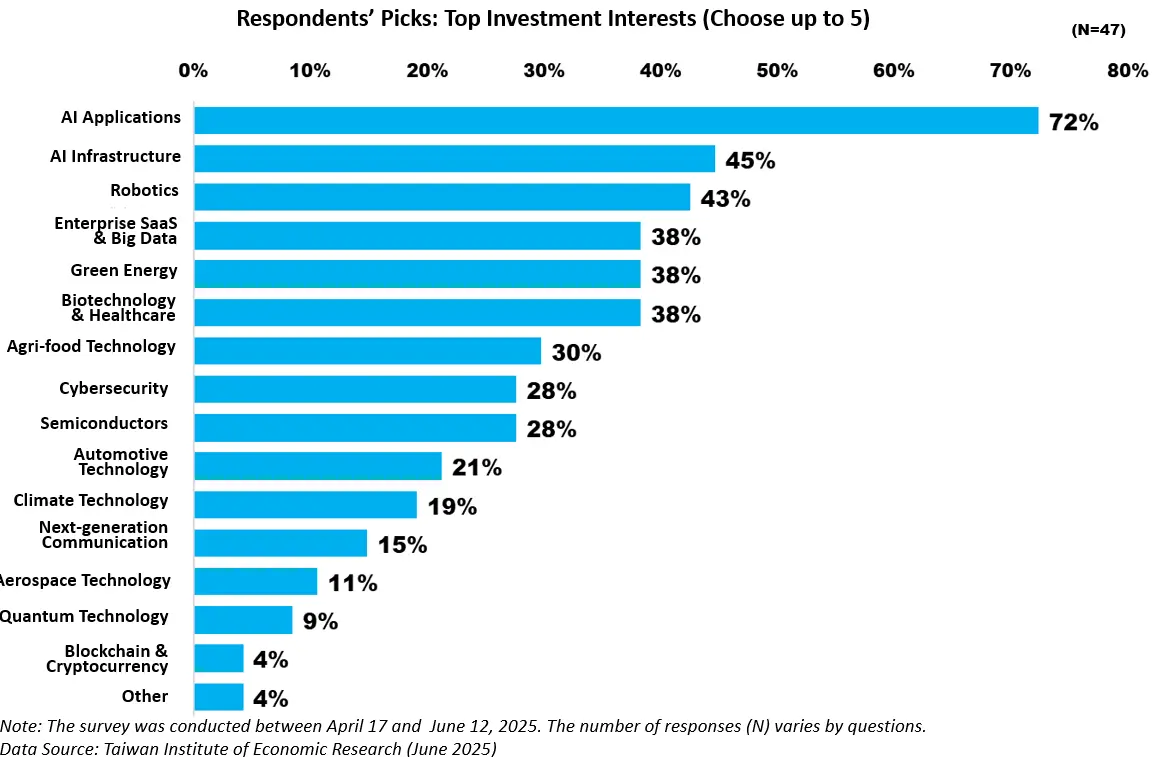

AI is undeniably a domain that investors must monitor closely and actively engage with. Yet, amid the ongoing surge in AI, a note of caution remains. Most respondents believe “AI Applications” (77%) and “AI Infrastructure” (66%) are already over-invested. Nevertheless, when asked about their preferred areas for future investment, AI still leads by a wide margin, particularly “AI Applications” (72%), followed by “AI Infrastructure” (45%) and “Robotics” (43%). The term FOMO (Fear of Missing Out) perhaps best captures investors’ mindset toward AI deals. As AI continues to dominate conversations, investors need a clear rationale and structured evaluation frameworks—regardless of whether they choose to invest or not—making this a critical lesson for investors.

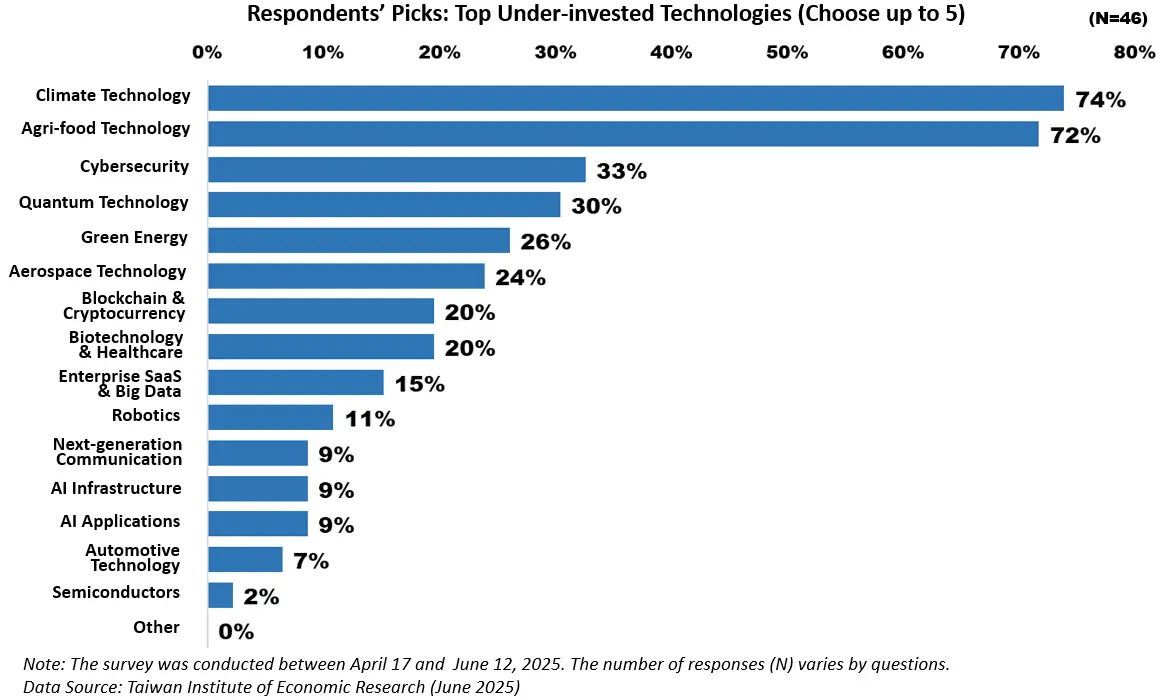

As for under-invested sectors, respondents pointed to “Climate Technology” (74%) and “Agri-food Technology” (72%) as the most overlooked, far ahead of “Cybersecurity” (33%) in third place and “Quantum Technology” (30%) in fourth. These results align with the investor survey released by PitchBook at the end of 2024 and reflect investor perspectives on key global challenges. Climate technology tackles pressing climate issues, from net-zero goals to energy security and efficiency, while agri-food technology addresses food security by developing resilient and sustainable systems. Although AI continues to dominate investment interest, rising geopolitical and economic uncertainty underscores the need for greater attention and support for climate and agri-food technologies.

4. Conclusion

Although investors generally anticipate a slowdown in the global and domestic venture capital markets in 2025 due to ongoing political and economic uncertainties, their investment confidence has not weakened. In fact, many are becoming even more proactive in expanding their investment scale, reflecting a distinct trend of “market cools, confidence holds firm.”

At the heart of this confidence is undoubtedly the rise of AI. As AI rapidly penetrates across industries, both applications and infrastructure continue to attract significant investor attention. Consequently, AI has become nearly a default component in every startup pitch. However, investors remain cautious amid the AI enthusiasm. Rather than blindly chasing hype, they focus on rational, well-grounded evaluations, returning to basics such as the fundamentals of the technology, business models, and potential returns.

Meanwhile, sectors with long-term value and social impact, such as Climate Technology and Agri-food Technology, may not be as eye-catching as AI but are still regarded as under-invested. These fields represent not only key directions for industrial transformation but are also closely aligned with global goals for sustainability, energy security, and food system resilience.

To summarize, while the venture capital market faces challenges from global instability and economic fluctuations, opportunities continue to emerge, driven by policy support and industrial transformation. Beyond riding the AI wave, investors should stay attentive to long-term opportunities arising from broader structural shifts in order to navigate the constantly evolving market landscape with stability and create enduring value.

![[Taiwan Startup Investments – Jan-Feb 2025] Notable Deals](https://findit.org.tw/Files//ResArticle/dbf3771b-a8a3-4099-b1ca-7740738e3318.webp)

![[Taiwan Startup Investments – Oct–Dec 2024] Notable Deals](https://findit.org.tw/Files//ResArticle/938d9709-3c8a-47c3-80ad-4d53767ed5b2.webp)

![[Taiwan Startup Investments – Aug-Sept 2024] Notable Deals](https://findit.org.tw/Files//ResArticle/c54eac3e-6f43-4320-ac62-d87274471f14.webp)